You have no items in your shopping cart.

We are carrying less and less in our wallets because of trends such as moving towards a cash-free society, and the wallet designs are changing because of it. A quick search on the crowdfunding site Kickstarter generates over 1000+ results for “wallet” and most of them are minimalist wallets, promising benefits such as thin, slim, less bulk, etc. Are we ready to dump our old bifolds and carry less? And what consequences does it have to remove cash in society?

Let’s face it: cash is on its way out. In 2012, cash accounted for just 40% of payments in the US and the number is steady dropping. Sweden is at the forefront of completely phasing out money, and other countries are following similar tendencies. The Bank of Korea is planning a cashless society by 2020. Recently France and Spain both enacted laws that limit cash transactions and it is now illegal in France to use cash for anything more than 1,000 euros. This is great for us minimalists who like to carry less and use minimalist wallets, but what are the consequences of putting all our information in apps and credit cards?

Wallets keep getting smaller. When it comes to wallets, thin is in – the minimalist wallet revolution is here to stay.

In Sweden, following a wave of armored car robberies, and excessive lobbying from the private financial sector to remove cash, many steps have been taken towards creating a cash less society. The crime wave has also forced busses to remove cash altogether, now you pay with your phone (which can quickly get confusing, especially for tourists).

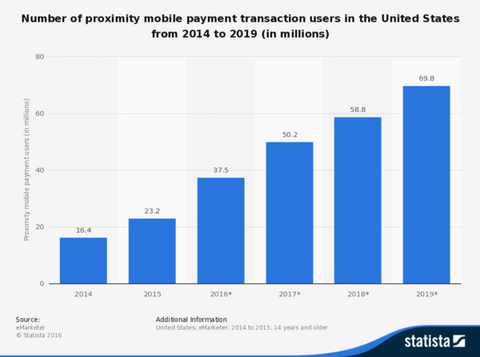

According to data from statista, there were around 23 million mobile wallet users in the United States, more importantly, that number is projected to triple by 2019.

Sweden has long been at the forefront of adopting new technologies and expanding the IT infrastructure (3d highest computers per capita and 5th highest “internet penetration per capita”). Another facilitating factor is the size of Sweden with its roughly 10 million inhabitants, about half the size of Los Angels, and a progressive IT- loving population always ready to adopt new technologies.

Banks are removing cash as fast as it can be done. Between 2010 and 2012 alone, more than 500 branches went cash-free, and 900 cash machines across the country were removed, placing Sweden as the country with the second-to-worst cash machine coverage in Europe. The worst affected places are rural areas where the few existing banks refuses to handle cash altogether. In Sweden bank cards are routinely used for even the smallest purchases, and cash in circulation has dropped significantly from less than 80 billion Swedish crowns in circulation (about EUR8 billion), from just six years ago, when the total in circulation was SEK106 billion.

In adjunct professor Niklas Arvidsson’s popular study “the Cashless society”, he predicts that Sweden will be cash free by 2030. Security is the bank’s main reason for removing cash from circulation, Cynics claim that the urgency by the banks to remove cash is because they can charge fees on card payments, visa-vi cash payments. Other concerns are the mountains of data available to banks about our every spending habit, which the private banks can use as they see fit.

Lightspeed Research reports that the most popular products being bought with mobile wallets are:

While cards have phased out cash, apps are now slowly starting to replace cards. But with nearly 2.4 billion credit card transactions in 2013, compared with 213 million 15 years earlier, cards are still the favored method of transactions, although they are seeing increasing competition from more and more cell phone apps, such as Swish, which allows you to transfer money via your phone with the swipe of your finger. Even after church service, when it comes time for collection, certain churches lets you use Swish instead of putting cash in the collection box. Apps like Apple Pay, Swish and others are competing with cards, but it is unlikely that they will phase out cards altogether, at least not anytime soon.

Cards have to a large extent phased out cash and apps are now starting to replace cards.

Even homeless street sellers of the magazine Situation Stockholm has recently armed themselves with card readers to adapt to the cash free society. Now, people cannot get away saying they don’t have any spare change; now they can pay with cards or text message, and sales of the magazine has since risen by 30%.

Will people even keep using wallets in the future? The answer is most likely ‘yes’, although the wallets will, just like Axess Wallets, be of the minimalist sort. Certain cards like driver’s license, various ID cards and such, will not be easily replaced, and cash will continue to be used for low level transactions.

All is not well with the move towards a cash less society. “Sweden has always been at the forefront of technology, so it’s easy to embrace this,” said Jacob de Geer, a founder of iZettle, which makes a mobile-powered card reader. “But Big Brother can watch exactly what you’re doing if you purchase things only electronically”. Indeed this is also something that benefits scammers; last year, the number of electronic fraud cases climbed to over 140,000, more than double the amount a decade ago.

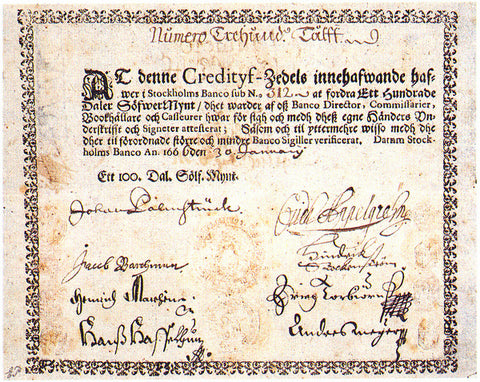

Is cash on its way out? In Sweden it sure looks like it. Ironically Sweden was also the first country in Europe to issue paper currency in 1666, featured in this picture.

While the removal of cash does make it much harder for the underground economy to function (read: drug dealing and other illicit activities), it does greatly extend the power of the government. Cash leaves few if any records, while it is impossible to hide electronic transactions. Regarding the underground economy, der Spiegel writes: "The markets for undeclared work and drugs could be dried out, and central banks would find it easier to enforce their monetary policies."

Martin Luther King Jr, Eleanor Roosevelt and Harriet Tubman are some of the new figures on the future US currency. But with the circulation of the new bills years away, will anyone still be using cash when they are printed?

Digital payments creates “a trove of data we have no control over”, says Rainey Reitman, activism director at the Electronic Frontiers Foundation. This could have many potential consequences to our privacy. Once this your transaction history is out there, it will become a target of government agencies such as the police and intelligence services and eventually make find its way into the hands of insurance companies, tax collectors, fraud squads, and even marketers and the like.

“Greenbacks aren’t going to disappear, simply because there are a lot of places on this planet that from the moment you step outside the airport, people love U.S. dollars,” says Greg McBride, the chief financial analyst at Bankrate, and he also pointed at the underground economy that needs cash to survive, not to mention any small transaction like tipping, which is still cash dominated. It looks like bills will still be around when Tubman and c/o arrive.

← Older Post Newer Post →